Performance

Asset

European Union Allowances (EUA) are a financial instrument under MiFID II, issued by the European Commission. Its supply is capped and decreases by design, progressively increasing its value. This has made it one of the top-performing assets of the past decade.

Past and future performance

The EUA spot price has increased by +25% annually in the last decade, outperforming most major asset classes. Looking ahead, experts agree on sustained price growth, consistent with the market's design.

Past and future performance

Historical returns

A strong price appreciation

An over +25% per year increase in the past decade, driven by strategic regulatory adjustments and market stabilization mechanisms, ensuring the long-term scarcity of allowances.

Price Forecast

Experts’ forecasts on the rise

Experts widely agree on a price appreciation over the coming years, with a consensus estimate of 120€-160€ by 2030.

Discover your potential returns with our simulator

Financial indicators

Return on investment

A forward-looking investment

EUAs have shown a solid +27.2% increase over the past decade, outperforming many other asset classes. They are an attractive addition to portfolios seeking diversification opportunities with strong returns potential.

Volatility

Behaving like a commodity

With a 90D average volatility of daily returns in 2023 of 2.24%, EUAs exhibit higher volatility compared to stocks and bonds, but lower than energy commodities. EUAs are considered a long-term asset suitable for patient investors seeking a buy-and-hold strategy.

Liquidity

A very liquid market

The EU ETS market is a huge, liquid market with close to a trillion euros of annual trading volume. It’s diverse participants include regulated entities, financial institutions, and investment firms trading 3 billion euros daily. It is becoming a global asset class.

This ensures that investors can enter and exit positions in EUAs with ease, contributing to a robust and stable market environment.

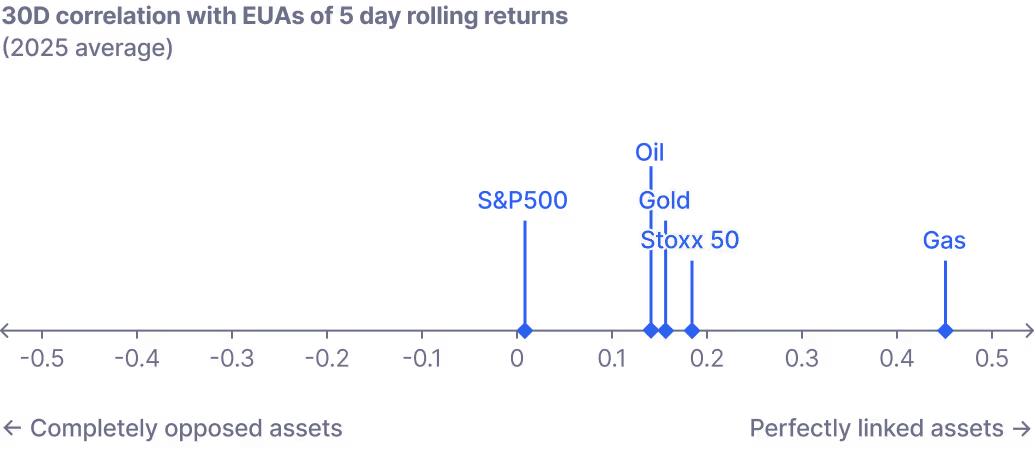

Correlation

A strong diversification opportunity

EUAs exhibit very low correlation with major asset classes such as stocks, bonds, and energy commodities. Its low correlation indicates that the price movements of EUAs are largely independent of those in other financial markets. This unique characteristic makes EUAs a valuable diversification tool within a balanced investment portfolio.

EUAs are a powerful addition to your portfolio

Homaio gives you financial exposure to the most mature and liquid emissions allowance market globally. As a private investor, you now have access to a financial asset ideal for a long-term, buy-and-hold strategy.